Loan Management System «Groshik»

Product Scope

- Efficient workflows

Clean up the back office with efficiency-focused workflows - Automated underwriting

Helps you to make faster consumer loan decisions - Mobile loan applications

Providing a convenient loan application experience for your customers - Flexible analytics

A complete end-to-end solution tailored to the needs of you and your customer - Reduce tasks

Automated processes help your lending team spend more time with customers

Key Features

Customer management streamlining

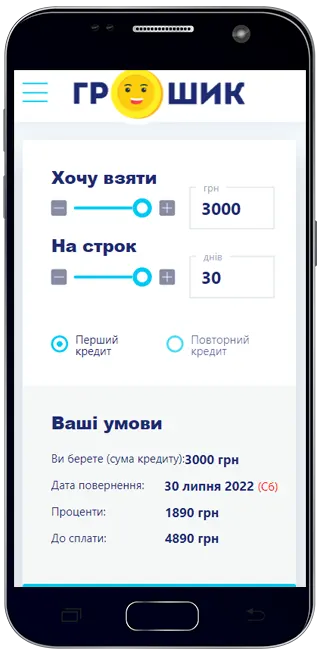

- Customizable promo site

- Customer profiles

- Loan application

- Multiple languages UI support

Marketing management

- Leads generators pairing

- Promo codes and notifications,

- Referral program

- Personal discounts

- Lead management and calls tracking

Business operations management

- Multi-company management

- Multiple payment systems support

- Extensive credit products settings

- Products with recurring payment settings support

- Customizable business analytics

Underwriting and risk management

- Credit history providers integration

- Antifraud, customizable blacklists

- Automated decision support system

- Internal scoring system capable of consuming 3-rd party score providers

Customer Service and Legal management

- Customer complaints processing

- Easily customizable agreement templates

- E-mails/SMS/calls automation

- Integration with IP-telephony

Debt Collection Management

- Acquired loans management

- Automated loans organizing in customizable portfolios

- Customizable loans restructuring

Security

- PCI DSS compliant

- Role based access control

- Extensive logging

Typical loan issue takes about 10 mins

New Client

- Sign up and fill the profile in a 3-step wizard

- Add and verify Bank Card

- Select Loan size and term

- Identity verification and liveness detection

- Receive the money

Repeat Client

- Log on to personal profile

- Automated or manual scoring

- Sign contract

- Receive the money

Flexible solution architecture and service delivery

- Cloud

- Deployment team

- SaaS

- Outsourced Support

- Inhouse Support

- Licensed

- Integration API

- On Premises

Quick facts

Loans issued

Registered Users

Avg application time

Deployment time

System uptime

Project Roadmap

Customer Communication Central

- Easy-to-use communications history from all sources

- Omni-channel communications automation

- Debt collection communication strategies

- External Call Center integration

Products capabilities

- Loans top-up

- Loans refinance

- Complex annuity products

- Forward payments

- Mortgage loans

- Switching customers between products

AI applications

- Dynamic customers segmentation

- Automated processes for ML models training and evaluation

- ML-based collection process

- Dynamic communication queues

- Customers’ social profile analysis

Contact Us

Contact Us